As a digital nomad, I want to cover my financial management now that I’ve been living abroad over four years. Here’s some info on how I manage my finances so I can keep myself afloat. Bitcoin has been an enabler so some of this info will focus on using Bitcoin in addition to the legacy financial system tools. This is not intended to be an in-depth guide. But more of a smattering of knowledge from someone who’s been at this for a little while now.

Things I like

Timesavers and basic utilities.

- Telegram (has the ability to locate people nearby who can help you)

- Binance (exchange crypto with no KYC as long as you keep under the radar)

- BitPay Visa Debit card (convert crypto to cash and withdrawl at ATMs worldwide)

- AND.CO (ridiculously easy way to create and send invoices, and get paid)

- M-Clip (keep your cash separate from your identity and credit cards)

- F-Droid (this is where you can find some amazing free and open source apps)

- GPG (protect your data with and manage your encryption keys)

- TabTrader (keep tabs on the price of cryptos)

Tips on managing your money

Suggestions for managing Bitcoin while living abroad:

Eliminate credit debt. As soon as you can eliminate credit card debts and work to use cash as much as possible. It’s okay if you build up a small amount of debt but don’t let it keep you from losing track of your bigger goals.

Build a passive income. Work on building a passive income. I was able to start doing this by building a website for a friend under the agreement he would share 20% of his advertising revenue with me. 4 years later that website now makes over $300 a month in ad revenue. And he pays in Bitcoin every month.

Accumulate bitcoin. Even if you only purchase small amounts at a time. Work on dollar-cost averaging into Bitcoin. Purchase a little bit of it over and over and make sure you keep it all in the same place (ideally on a hardware wallet). In time that Bitcoin will add up. Think of it as your retirement account.

Stay organized. Pick a password manager and stick with it. I’ve encouraged others to use KeePass for over 10 years. If you’re the type who tends to lose stuff, use Bitwarden instead. Both have their benefits and drawbacks. Do your homework so you are confident in your tool and use their folder feature to group like items.

Keep backups of your data. It’s imperative to keep back-ups of all your data. Make sure any back-ups of your seed phrases are properly encrypted. And make sure your back-ups use the 3-2-1 backup strategy to avoid data loss.

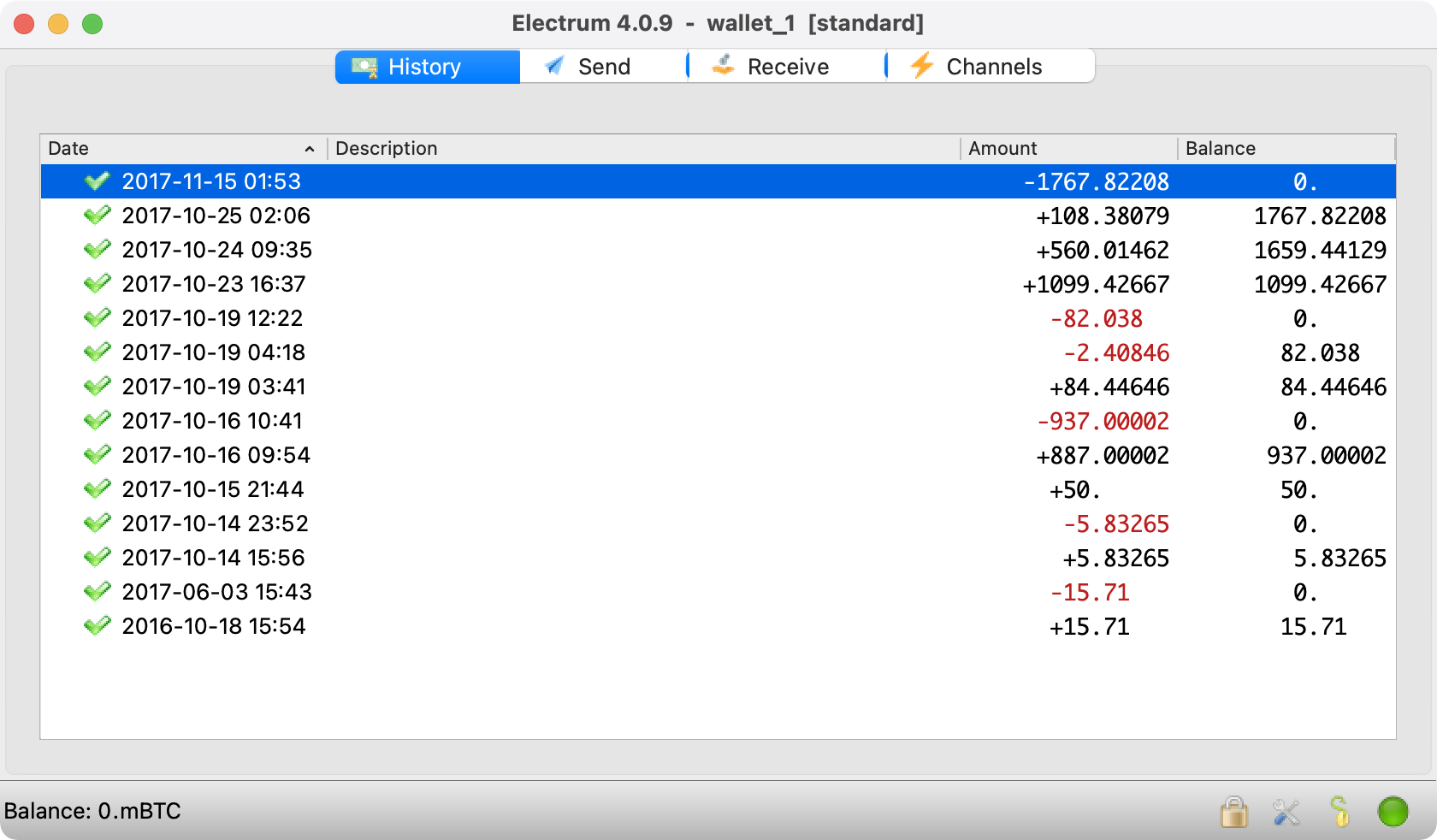

Keep transaction logs. Any decent crypto wallet will allow you to annotate your transactions. Take advantage. Because unless you’re keeping track of every Bitcoin address you’ve ever used you may find yourself in a pickle later trying to figure out what you did with your Bitcoin when it left your wallet:

Keep a personal journal. Life has the tendency to slip by quickly in retrospect. Keep a personal journal using a plain text with an app like Diary so you can tie back transactions to what was happening in your life at the time. You’ll also find a journal can be a good way to reflect back on your progress as a human.

Keep custody of your wallet. DO NOT let your cryptocurrency sit in an exchange unless in small amounts or as a temporary convenience. No matter how infalliable an exchange may seem, a change in state regulations or personal circumstances can cause the exchange to treat you differently, potentially freezing your assets.

Avoid unnecessary fees. When using Bitcoin or Ethereum blockchains pay attention to the current transaction fees and, in the case of Ethereum, the gas prices. Try and send money when fees are low in order to save yourself money. High fees is one of the main reasons I prefer to use Bitcoin Cash as opposed to Bitcoin.

Mind KYC policies. Some crypto-related services are required by law to collect customer data for the purpose of helping prevent money laundering. Once KYC-free tools like Shapeshift started collecting customer data a couple years back which means they may also freeze your assets. Avoid these services like the plague.

Preferred wallets

Since I started using crypto in 2016 I’ve tried a number of different wallets. Here are the wallets I still use today and some brief comments about them:

-

Electrum. Good wallet. The first one I ever used and still trust it more than any other wallet out there. If I didn’t use a Ledger I’d keep my savings here. Its only downfall is that the user interface looks like complete ass.

-

Ledger. Decent wallet. The concept of a hardware wallet I like a great deal becuase it gives you a physical object you can assign a value to. Sadly my Ledger wallet has experienced a hardware-power issue under only light use.

-

Bitcoin.com Wallet. Great wallet. There was a time I had issues with this wallet on my phone but that’s since been resolved. This is by far the easiest wallet to use and I recommend to all first-time mobile wallet users.

-

BitPay. Great wallet. I’ve used this wallet for a few years to help turn my crypto into cash I can pull cash almost any ATM worldwide.

-

Samourai. Decent wallet. Samourai is a botique wallet for those who want more privacy in their day-to-day transactions. The problem I have with it is that some features aren’t obvious and it makes the wallet harder to use.

-

Exodus. Meh wallet. I used to love this wallet and it was one of the first I ever used. A couple weeks ago I had my girlfriend try using its crypto converter and it failed and the money wasn’t returned. It’s been several weeks and we cannot get an actual human support rep to help us recover the funds.

Worth mentioning

Things others in my circle discuss or use:

- Payoneer. I know several people who use this to manage finances.

- Local Bitcoins. Find people in your area to buy and sell Bitcoin.

Have something valuable to share? Let me know!

Pulling away

If you feel like you cannot go anywhere because of all this COVID nonsense (and believe for the truthers it is total bullshit) just pull up the UN website and start reading:

Everyone has the right to leave any country, including his own, and to return to his country.

United Nations, Universal Declaration of Human Rights, Article 13.2

A word of caution

After mostly pulling out of the legacy financial system and learning to avoid paying income tax using the Foreign Earned Income Exclusion I’ve had some irritating stuff happen to me with FinTech companies. Since I left the US Robinhood froze my account and all assets in it FOR AN ENTIRE YEAR and canceled me without reason. TransferWise also canceled my account within 3 days after signing up and rejected my appeal stating I was too risky (whatever that means). Stripe almost canceled my account too, until I went to Hacker News with the story. Stripe thankfully fixed the problem within one day.

Summary

In this post I’ve given you tips for managing your finances as a digital nomad. I’ve covered some things I like, some I don’t, provided suggests for better financial management using Bitcoin and given you my personal opinion of several cryptocurrency wallets I prefer using.

As we’ve seen amidst the COVID scandal the things states and people at large are willing to do based off the results of fradulant diagnosis tools like the PCR test when subjected to 24-7 corporate media fear mongering is unbelievable.

Should you wake up and find youself in a place continuing to violate your freedoms tomorrow, will you be in a position to stand up for what you believe? Will you have the financial means to do what you know in your heart is right? Every person on this Earth is born free. It’s up to each of us, individually, to do what we can to keep it that way. And Bitcoin can help get us there. But only if we use it based on Satoshi’s original design as a peer-to-peer system.